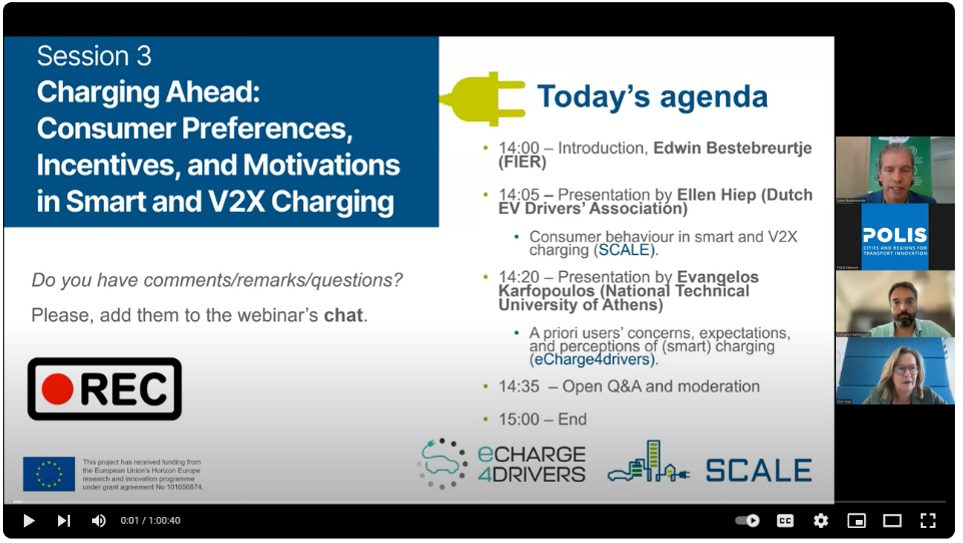

eCharge4Drivers was delighted to take part in the third webinar of the SCALE Summer Series, which focused on the consumers, their preferences, incentives, and motivations in smart and V2X charging. Evangelos Karfopoulos, Project Coordinator at ICCS, presented the eCharge4Drivers study on EV drivers’ a priori concerns, and Ellen Hiep of the Dutch EV Drivers’ Association, presented SCALE research on consumer behavior in smart and V2X charging. Edwin Bestebreurtje of FIER Sustainable Mobility facilitated the discussion.

An overview of how EV drivers in seven European countries look at vehicle-to-anything (V2X) and smart charging (Ellen Hiep)

As part of SCALE and with the help of the Global EV Alliance (GEVA), the Dutch (VER) and Norwegian (Elbil) EV drivers’ associations, a thorough study was conducted this year to learn more about the opinions of electric drivers about V2X and smart charging. The study was carried out in seven European countries (Hungary, Poland, Portugal, Slovenia, Austria, Norway, and the Netherlands) and resulted in the participation of more than three thousand electric vehicle drivers. In-depth expert interviews with representatives of EV drivers in these nations were also conducted by the two EV groups. A SCALE deliverable with the survey findings was made available here.

Ellen Hiep presented an overview of the key findings from the survey:

Smart charging

- Respondents were aware of what smart charging is and were either willing or already doing it.

- Their motivations for smart charging are the financial gains and because it is more environmentally friendly.

- Drivers want to have control and insights over the smart charging sessions.

- Most users trust OEMs or grid operators/electricity providers to control their smart charging process. There are variations between countries: while in Poland, users trust car manufacturers twice as much as grid operators, in the Netherlands, it is the opposite. Many users stated that they only trust themselves and no third parties.

- Recommendations: Addressing user needs and expectations while effectively communicating the benefits of smart charging will be key to widespread adoption.

V2X

- Most drivers recognize the value of V2X with a strong preference for V2H (Vehicle to Home) options such as solar panels and smart house technology. Again, there are variations related to local context. In the Netherlands, 45% of users claimed they would want to use V2X to contribute to overall grid stability. This was the lowest priority for Norwegian EV drivers.

- 8 out of 10 EV drivers have concerns related to V2X adoption. The biggest ones are battery degradation (these where higher in countries with lower EV penetration rates), fears that their EV will not have enough battery capacity when they need it and handing over control of charging.

- The willingness to participate in V2G is not very high but increases a lot when there are financial benefits.

Going further

- It is crucial to differentiate between smart charging and V2X, as they represent distinct concepts that require a differentiation of strategies for adoption.

- The literature review shows a lack of consumer-oriented research on smart charging and V2X technology.

- The varying perceptions toward V2X adoption, concerns, and interests, needs to be taken into consideration when this new technology is being debated and developed.

EV Charging Infrastructure for improved User Experience: A priori user survey (Evangelos Karfopoulos)

eCharge4Drivers is enhancing the EV charging experience in urban areas and on trans-national corridors. It offers user-centric and interoperable solutions including improved charging infrastructure, e-mobility services and decision support tools.

What are EV drivers’ main barriers?

A survey undertaken in 2020 and 2023 by SBD Automotive showcases shifting EV drivers’ barriers as the market matures. Range anxiety and the price of EVs are decreasing barriers for drivers to get an EV.

A 2021 eCharge4Drivers survey (see deliverable here), which collected around 3,000 responses, found the following:

- Drivers prefer to charge at home. Around 90% of users charge at home, but also want access to public charging.

- They park for approximately 12 hours, ideal for smart charging services.

- Smart charging flexibility: users can provide between 45 min and 3 hours of flexibility during slow charging and 30 min to an hour for fast chargers, with smart charging better suited for slow charging.

- Public charging point occupancy is low: it varies from 9% to 32% (in rare cases).

- Users are willing to pay more for fast charging solutions.

- Most survey respondents were male, suggesting a need to actively work on strategies to include women in the e-mobility evolution and make it more gender-balanced.

How can some of the EV users’ barriers be overcome?

- Implement pricing policies that are simple and transparent via mobile applications as well as on the charging station. Allowing ad-hoc payment without any contract is crucial.

- Provide e-mobility services facilitating user’s accessibility and charging experience (routing, booking, smart charging).

- Offer diverse charging technologies (public/private, AC/DC) to adequately develop charging infrastructure, including V2X and options for light vehicles (e.g., battery swapping).

- Plan an adequate (public) charging network considering grid constraints and maximise the usage of existing charging network.

- Offer incentives and advanced tariffication schemes to support the wide deployment of charging infrastructure.

Successful deployment of smart charging in Grenoble

As part of eCharge4Drivers, a demonstration in Grenoble showcased the correlation between EV charging and PV production. Smart charging was done in more than 90% of the cases by the users (it is an acceptable and beneficial service for EV users) and it led to a 20% cost reduction and a 95% increase in solar self-consumption.

eCharge4Drivers is currently in the demonstration phase, testing smart tariff acceptance in Barcelona, exploring auto consumption in Grenoble, and gamifying charging certificates in Luxembourg.

Key discussion points during the panel

- Is there a European or common understanding of what V2X and smart charging is? No, and this may be complicated due to national variations in its conceptualisation and the number of parties involved.

- Is V2H popular because it’s what users understand best? It’s easier for users to see the benefits of Vehicle to Home because they can directly benefit from cheap and green energy, and financial gains. They have and see the direct connection between the home and the vehicle. It’s a great way forward to start the V2X transition. Overall, EV users want to know what and how they can benefit from smart charging or V2X.

- Business models: V2G and V2X are different concepts with various business opportunities. V2H is limited only to the house, but V2G could provide wider services to more stakeholders. However, currently there are few mechanisms to fully exploit the V2G functionality.

- There are still few V2X capable vehicles: For users, it’s not (really) possible for most EV drivers to use the technology yet. In addition, in most European countries, V2G is not possible especially in for public charging.

The full webinar is accessible on YouTube here. The presentations can be downloaded below: